Interest Rate Hikes

Five Thoughts on Today’s Interest Rate Hikes

By Jerry Wang, Personal Real Estate Corporation

1. RATE HIKES CAUSED RENT HIKES

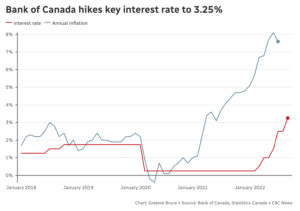

When the Bank of Canada increased its overnight interest rate again, already-priced-out purchasers turned to the rental market, which resulted in rapid rent increases. The demand for housing simply has not diminished because of rate hikes in large part due to lack of available supply. Savvy investors have cashed out of the stock market and the volatile digital currencies, once again making land investment, the safer long game.

2. AVERAGE PRICE DOWN FROM Q1 2022

The average home price has fallen from Q1 2022, so what does this mean for entry-level homes? After the first interest rate hike in March, the housing market began to slowly cool and the sales to listings ratio subsequently increased. Sellers were divided; those who needed to sell, lowered their asking prices, while others (who were not as motivated) took their properties off the market – and the market stabilized. Rental demand pushed 1 bedroom rental rates to an all-time high and this past Summer, we began to see would-be renters jumping into the first-time buyer market; a result of expiring rate holds and a crucial moment where monthly rents and mortgage payments reached an equilibrium.

3. WHERE ARE THE OPPORTUNITIES RIGHT NOW?

Developers only sell homes when they can calculate a reasonable ROI, which is typically a 15-18% return on their costs. The resale market might fluctuate rapidly, but land costs simply do not drop overnight.And as borrowing costs rise, along with uncertain construction costs due to supply issues, developers will choose to hold off on launching new projects if they cannot find a pathway to profit, or they will source alternative ways to self-finance their projects through construction. While the latter is more financially challenging, selling finished product provides developers with 100% cost certainty. Regardless, both of these scenarios severely impact market supply and this will make for challenging times ahead for sellers, buyers and renter

4. SO WHO DO THESE RATES AFFECT?

It is important to understand that buyers are not the only segment affected by interest rate hikes. This affects developers looking to finance land for the purpose of redevelopment too. Presale buyers have a certain degree of leverage in the market right now, especially with developments currently under construction with unsold inventory. Leverage can come in the form of: pricing discounts, bonuses, decorating allowances and no-charge upgrades. Agents should be keeping tabs on these incentives because they won’t last forever. Can’t seem to find a suitable resale property for your client? Perhaps you should be looking for presale assignment opportunities, particularly at a time where assignors are finding it increasingly difficult to secure suitable financing for properties closing within the next 12 months.

5. YES, PRESALE BUYERS CAN LOCK IN THEIR RATE HOLDS FOR UP TO 12 MONTHS

No one is feeling more anxious about interest rate hikes than buyers holding presale contracts for developments under construction and closing within the next 6-12 months. But did you know that the big banks like TD and BMO are extending their “Builder Capped Rate Programs” to buyers? These rates can be locked for 12 and up to 36 months with no obligation at completion, giving buyers 100% flexibility when it comes to financing their next home. These types of programs also send a confident message to the market: banks do not foresee rate hikes lasting much longer and they anticipate that rates will stabilize moving forward.